AUSTIN, Texas, June 20, 2014 (GLOBE NEWSWIRE) -- A new TG study, "Financial Aid at the Crossroads: Managing the Student Debt Crisis in Texas," underscores the personal and professional obstacles that Texas college students face because of rising college costs and growing indebtedness. Of the outstanding student loan debt held nationally, roughly $1.2 trillion, Texans now account for approximately $70 billion, and more than one-sixth of Texas borrowers will likely face the consequences of default within three years of entering repayment.

"These trends should concern all of us in the higher education community," said Jeff Webster, assistant vice president of TG's research and analytical team. "The study outlines how Texas students have been affected by the lack of college affordability and the resulting over-dependence of student loans; their lack of other adequate funding options; and their deficiencies in basic financial literacy skills."

High student loan debt has negatively impacted economic recovery as well, in the form of housing purchases and rates of entrepreneurship, particularly for the average 30-year-old student loan borrower. Furthermore, borrowers with student loan delinquencies and defaults face the repercussions of lower credit ratings.

Citing data from the National Financial Capability Study (NFCS), which showed only a third of Texans understand everyday financial matters, TG's report recommends several strategies that could help students successfully manage their student loans, as well as their other financial obligations.

"Higher education is an investment. Like other types of investments, one should research the expected return before borrowing," advised Webster. "Comprehensive, well-timed loan counseling that is coordinated with academic advising and career guidance can help overcome those first difficult decisions students must make.

"The study outlines various recommendations to state and federal policymakers regarding aid funding, and why we should work together to promote loan counseling and repayment options through a statewide initiative," he said.

Financial Aid at the Crossroads: Managing the Student Debt Crisis in Texas can be found at www.TG.org.

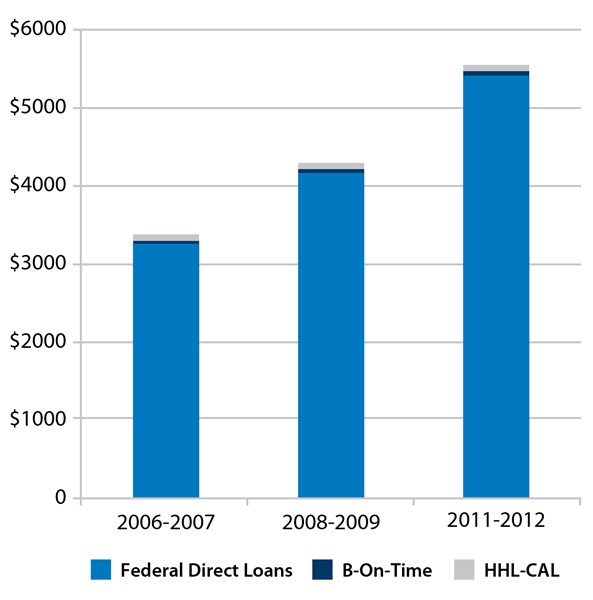

A photo accompanying this release is available at: http://www.globenewswire.com/newsroom/prs/?pkgid=25985